…Said Mayor Leonardo Williams in his opening remarks as the keynote speaker for the BisNow State of Commercial Real Estate for Durham, NC, held this week at APG Companies’ Overlook building at 4825 Creekstone Dr in Durham.

Durham’s rapidly growing population, vibrant walkable downtown, green infrastructure, and significant investments—such as Google’s presence—attract top talent. Despite gaining national attention, the city faces local challenges.

With 41% of its businesses locally owned, Durham demonstrates strong community engagement. Nonetheless, it confronts several key hurdles, including an overburdened convention center, a shortage of hotels, and gaps in law enforcement staffing.

As the third-largest city in North Carolina, Mayor Williams highlighted the city’s rapid growth—from 289K to 318K residents in just 6 to 7 years. He emphasized his strategy focused on People, Policy, and Product—reimagining infrastructure, strengthening public-private partnerships, and fostering innovation.

The panel discussion, moderated by APG’s John Zemet, CIO & COO, focused on Durham’s current commercial real estate landscape and future trajectory.

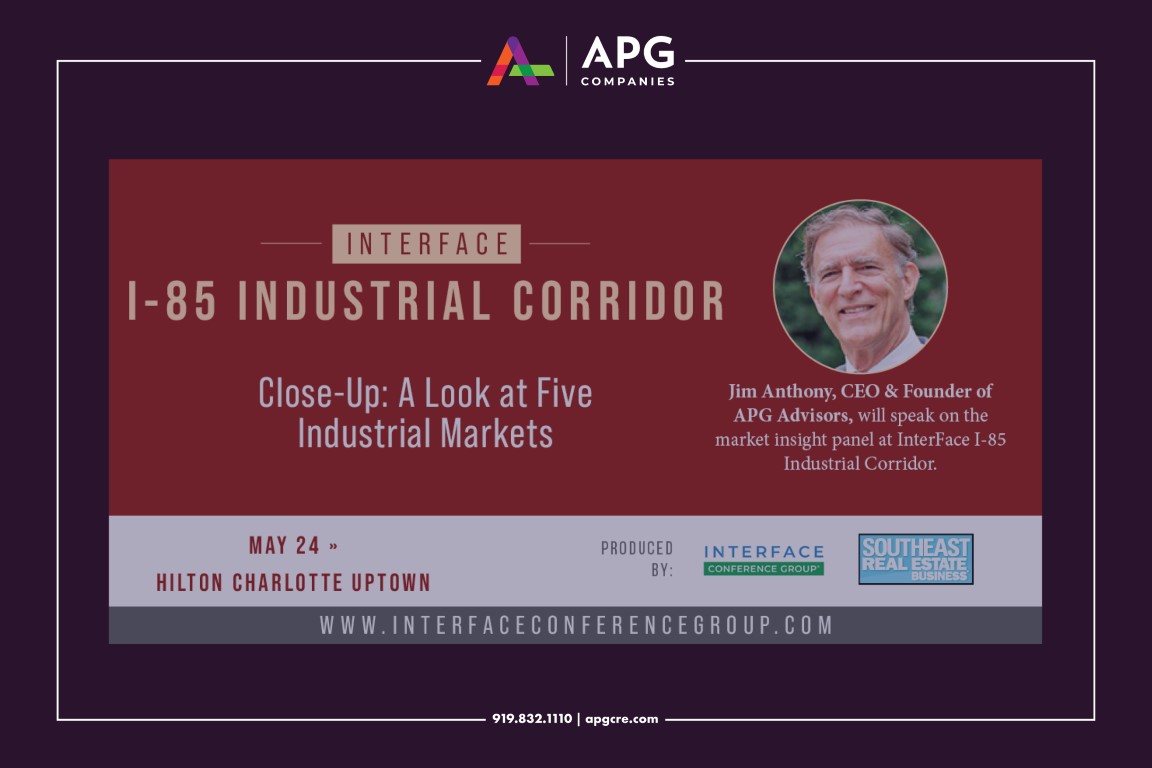

Panelists include APG’s CEO and founder, Jim Anthony; Zach Prager, Partner and Director of Investments at Austin Lawrence Partners; Elizabeth Smith, SVP of Development at AvalonBay Communities; Austin Williams, Partner at Crosland Southeast; Jeff Kurtz, SVP of Development at Ram Realty Advisors; and Jay Douglas, Executive Director at The Ardent Companies.

Here are the highlights:

What makes Durham stand out for development and acquisitions compared to other areas of the Triangle?

- Strong Demographics – Rapid job & population growth, plus an influx of young professionals securing high-paying jobs.

- The ‘Cool Factor’ – A unique culture and vibrancy that sets Durham apart.

- Public & Private Investment – A collaborative approach driving innovation and expansion.

The Retail Market

- “De-Malling the Mall” – the retail landscape has transformed from its 2005 landscape, where shopping was dominated by power centers or regional malls like Southpoint, North Pointe, and Crabtree Valley. Today, retail follows the rooftops—and the influx of young professionals with high-paying jobs is driving retail demand for mixed-use developments over traditional malls.

- Work, Live, Play – Durham’s focus on integrated, walkable spaces aligns with modern lifestyle preferences, making it a prime destination for businesses and residents.

- Local vs. National Retailers—With 41% of businesses locally owned, Durham reflects strong community engagement. Attracting local businesses to mixed-use developments creates a dynamic retail mix, but soaring TI (tenant improvement) costs pose challenges for landlords and tenants.

How Does Durham’s Multifamily Market Compare to Other Triangle Locations?

- Strong Demand Drivers – High-income growth, job expansion, and migration fuel demand.

- Supply Pipeline Impact – A wave of new developments is expected to put downward pressure on rent rates.

- Public-Private Collaboration – The community and municipality work together to shape growth.

- Co-Living Trends – Zoning changes now allow up to six unrelated individuals to share a home, but co-living in Durham remains less prevalent than in other metros. However, roommate-style housing is driving demand for three-bedroom units.

What Does Office Demand Look Like, and Is There Viability for Future Development?

- “It’s not overbuilt—it’s under-demolished.” Outdated office space remains a challenge.

- Uncertain Stabilization – The market may not fully stabilize five years from now.

- Redevelopment Potential – While opportunities exist, they will be outside of downtown.

- RTP’s Transformation: Expect significant mixed-use development on the horizon. The land around the formerly massive IBM Campus in RTP may even one day evolve into the next central downtown hub.

- Shifting Preferences – The trend is moving toward mid-rise mixed-use developments rather than traditional high-rise towers.

- Private Office Demand – We are trending toward individual offices over co-working spaces.

How Does Durham’s Zoning Process Compare to Other Triangle Locations?

- The Housing Crisis Was Brewing Long Before It Had a Name.

- Excessively slow process – Some projects, like a 200-townhome & retail rezoning in North Durham, have been stuck in the pipeline for nearly six years.

- Staffing Shortages – Durham needs more personnel in zoning, entitlements, site plan approvals, inspections, and permitting to meet demand and accelerate progress.

Thank you to all the panelists for providing great insights and presenting them in a valuable and relatable way.

What are your thoughts on these challenges? Let’s discuss it! #DurhamNC #CommercialRealEstate #APGAdvisors #APGCapital

Recent Posts

January 23, 2023

March 24, 2025

February 21, 2025

February 13, 2025

January 24, 2025

January 7, 2025

January 3, 2025

December 11, 2024

November 19, 2024

November 7, 2024

November 6, 2024

October 31, 2024

September 13, 2024

September 12, 2024

August 28, 2024

August 9, 2024

August 2, 2024

July 9, 2024

June 13, 2024

May 31, 2024

May 31, 2024

April 22, 2024

April 16, 2024

April 10, 2024

March 29, 2024

February 28, 2024

February 22, 2024

December 14, 2023

October 31, 2023

October 12, 2023

August 9, 2023

May 24, 2023

April 25, 2023

March 16, 2023

February 9, 2023

January 23, 2023

March 24, 2025

February 21, 2025

February 13, 2025

January 24, 2025

January 7, 2025

January 3, 2025

December 11, 2024

November 19, 2024

November 7, 2024

November 6, 2024

October 31, 2024

September 13, 2024

September 12, 2024

August 28, 2024

August 9, 2024

August 2, 2024

July 9, 2024

June 13, 2024

May 31, 2024

May 31, 2024

April 22, 2024

April 16, 2024

April 10, 2024

March 29, 2024

February 28, 2024

February 22, 2024

December 14, 2023

October 31, 2023

October 12, 2023

August 9, 2023

May 24, 2023

April 25, 2023

March 16, 2023

February 9, 2023

January 23, 2023

- 1

- 2

- 3

- 4

- 5

- 6