Charlotte remains the Southeast’s logistics workhorse, the Triad is stacking build-to-suit wins, and the Triangle is converting innovation into flex and advanced manufacturing demand. Together, they give occupiers and investors more than one way to win depending on timing and needs.

Charlotte: supply to digest, fundamentals intact

After a multi-year construction surge, Charlotte is working through elevated availability, especially in larger suburban/exurban boxes. Big-box availability is in the low teens; small-bay infill remains tight. Leasing timelines have lengthened, rent growth is normalizing, and concessions have firmed up for newer bulk space. The core drivers—location at I-85/I-77 and a deep labor pool—are unchanged. New starts have cooled well below 2022 levels, which should help conditions stabilize into 2026 if absorption holds.

Triad: commitment-heavy pipeline, steadier vacancy

In the Triad, much of the near-term supply is spoken for – a mix of build-to-suit, owner-occupied mega-projects, and select pre-leases tied to large retail distribution, the battery supply chain, and adjacent manufacturing. That commitment, not just traditional pre-leasing, helps limit vacancy pressure versus pure spec markets. There’s still speculative product in a few submarkets, but fewer fresh spec starts have kept overall risk contained. For tenants, the takeaway is to plan ahead; the best blocks are secured early. For investors, the Triad offers yield and credit at a lower basis than Triangle flex or Charlotte infill, with delivery timing the key variable to watch.

Triangle: flex/R&D premium with broader manufacturing demand

Raleigh-Durham has delivered a lot of space, so vacancy sits above its long-term average. Even so, leasing has been consistently positive, and flex/R&D still commands a premium thanks to workforce depth and proximity to innovation. Most active users are “make-and-move” operators – running assembly or biomanufacturing alongside warehousing rather than pure distribution. With speculative starts slowing, the setup into 2026 looks more balanced.

What Matters Now

Occupiers

- Charlotte/Triad work well for 500–800K SF modern logistics.

- The Triangle works for 40–150K SF flex/light manufacturing with talent access.

Investors

- Charlotte: A big market with rent-increase upside in infill; be conservative on lease-up timelines for large new warehouses.

- Triad: Solid cash-on-cash returns with many pre-leased/build-to-suit deals, and you can usually buy in cheaper.

- Triangle: Stronger rents hold up in quality flex/R&D and near production sites, so income is more resilient.

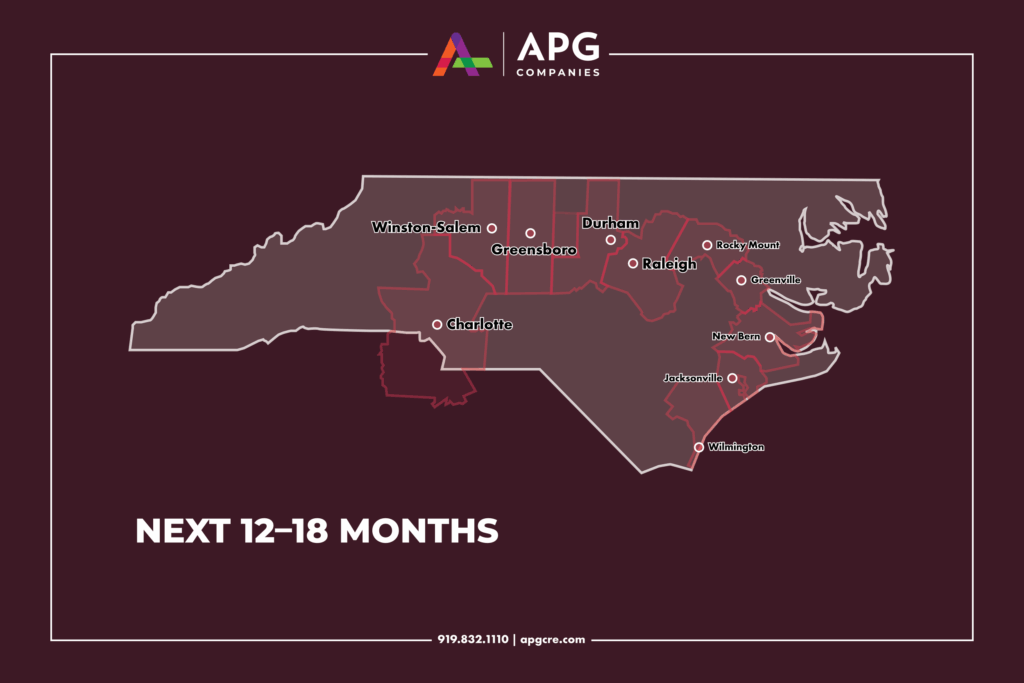

What to watch (12–18 months)

- How quickly the recent deliveries lease. The key near-term variable is how quickly Charlotte’s large-box segment leases up.

- Old vs. new. Tenants continue to trade up; older product competes with upgrades or sharper pricing.

- People & power. Site selection will follow workforce depth and available electric capacity.

- Deal signals. Free rent, TI packages, and annual bumps will telegraph who has leverage.

- Pipeline commitment. Expect the Triad to maintain a higher share of committed projects (BTS and owner-occupied) into 2026, which should keep vacancy increases more moderate than in Charlotte or the Triangle.

Bottom line: Think of North Carolina as one connected market. Pick the right metro for your need or investment, and you can run three different strategies without leaving the state.

“This next phase isn’t about volume—it’s about precision. Users are shaping the pipeline. We’re helping clients choose where a build-to-suit, a modern logistics box, or a flex/R&D footprint creates the most value—often just one exit apart.”

— Daniel Walser, VP, Acquisitions & Syndications, APG Companies

Coastal note: For port-oriented or user-buyer plays, Wilmington and select east-of-I-95 markets can complement a statewide strategy – mind Wilmington’s delivery timing and the tiny-base dynamics elsewhere.

APG Companies: North Carolina industrial real estate – Charlotte • Triad • Triangle. Build-to-suit, logistics, flex/R&D, acquisitions and syndications.

Learn more at www.apgcre.com.